Starting a business in Saudi Arabia is an exciting venture, but it comes with its own set of responsibilities and Value Added Tax (VAT) compliance is one of the most critical.

Don’t let the thought of tax forms intimidate you! The Zakat, Tax and Customs Authority (ZATCA) has streamlined the process online. This guide breaks down the essential steps to ensure your business remains compliant and avoids unnecessary penalties.

Before you even worry about forms, you need to know if your business must register for VAT in the first place.

- Mandatory Registration: If your annual taxable supplies (sales) exceed SAR 375,000, registration is mandatory. You must apply within 30 days of reaching this threshold.

- Voluntary Registration: If your annual taxable supplies exceed SAR 187,500, you can choose to register voluntarily.

- The Standard Rate: Saudi Arabia’s standard VAT rate is 15%.

Keep in Mind: Even if your business has no sales for a tax period you must still file the VAT return to stay compliant.

Step by Step Filing via ZATCA Portal

Most people think that VAT filing is a hideous procedure but in reality it’s just as simple as signing up for a new Gmail account. The entire VAT filing is done electronically through the Official ZATCA Website.

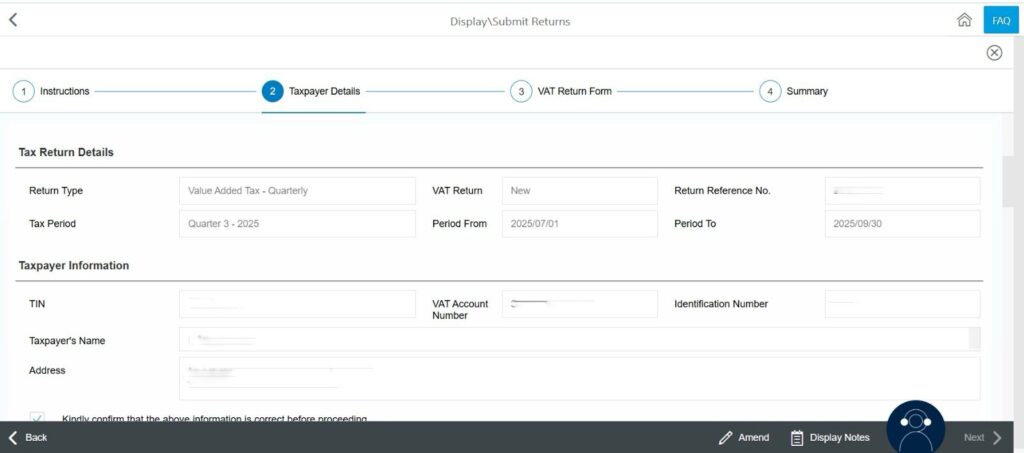

So let’s get into the basics, the first and foremost thing is to note down the TIN number. TIN number can be seen on the top left corner of your VAT registration certificate.

Then go to https://zatca.gov.sa/ar/Pages/default.aspx select Log in ,

- Log in using your TIN and Password

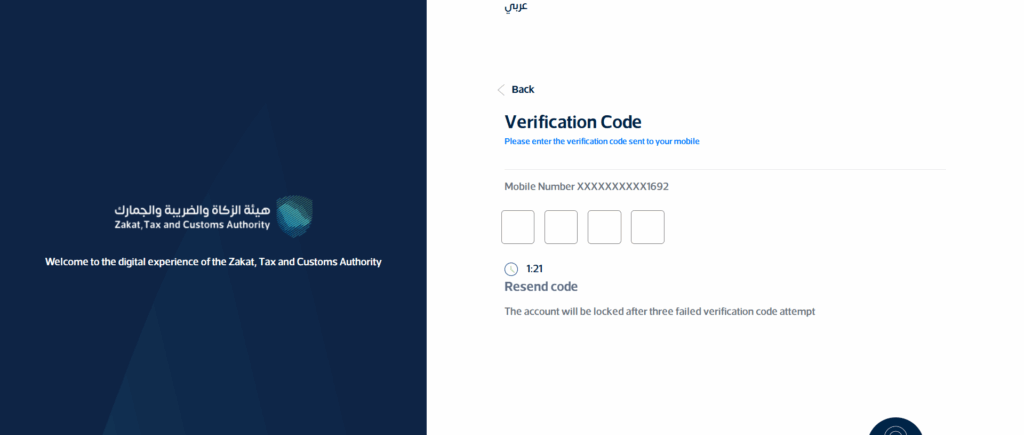

- Once you log in, an OTP will be sent to your registered mobile number.

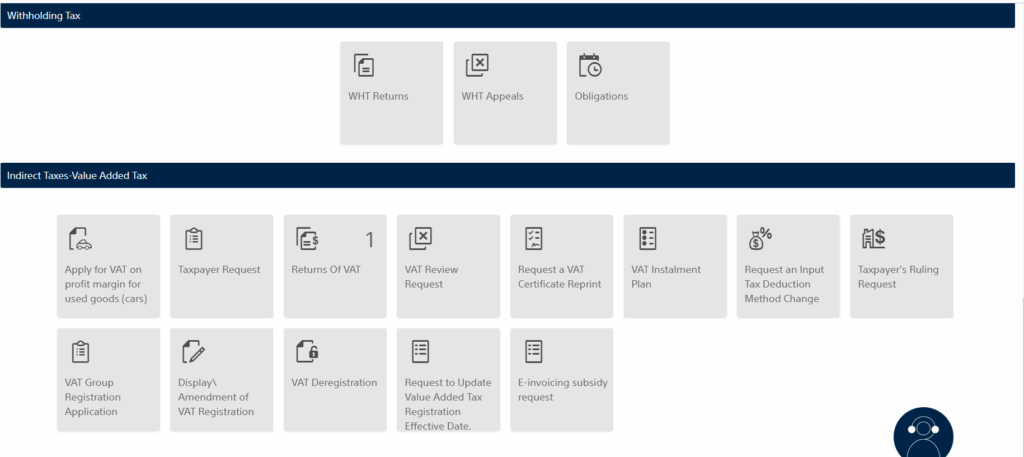

Move to “Zakat and Tax Services “ then go to “Returns of Vat”

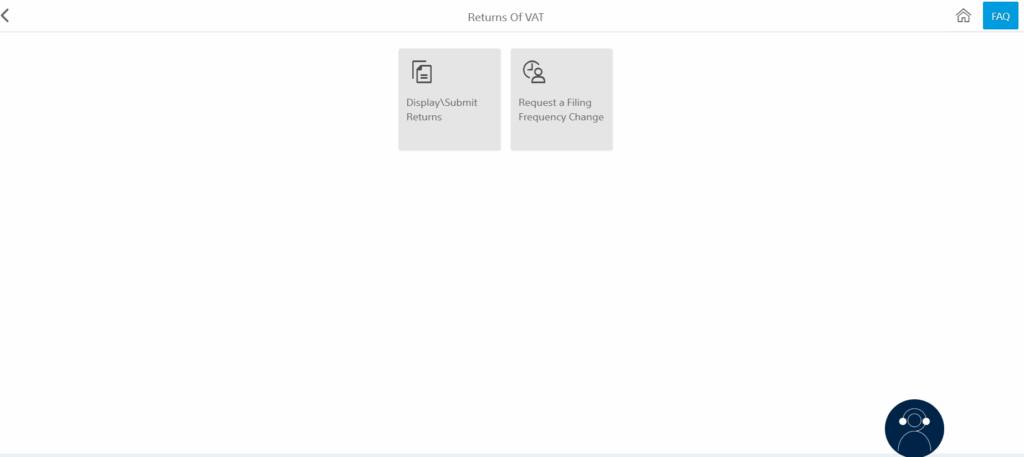

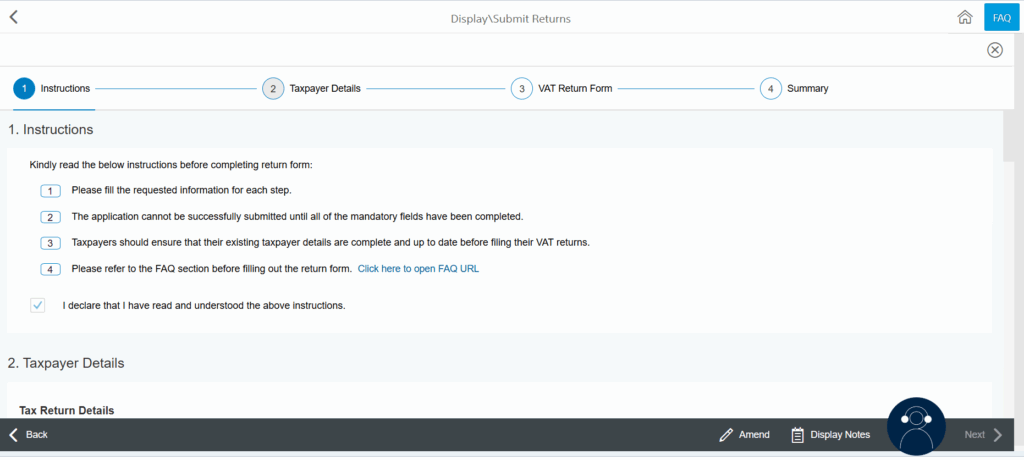

Select Display/ Submit Returns

Under the instructions tab, tick the box next to the declaration.

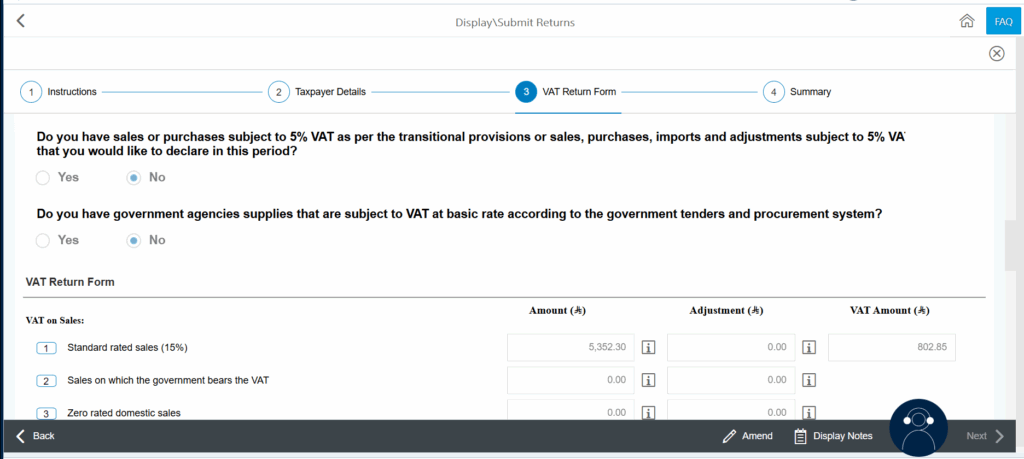

Go to the “VAT Return Form” section

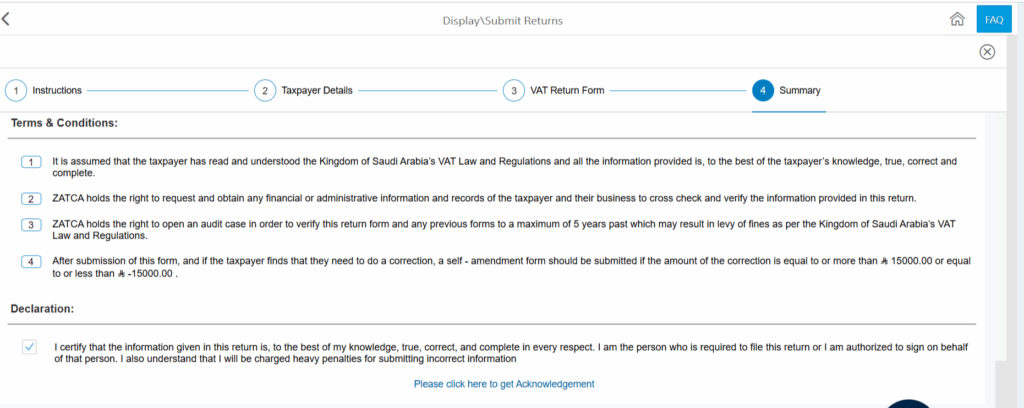

- And as the final step, Submit the request.

- You will receive a notification confirming the receipt of the return and also the invoice amount via SMS and email.

Few terms to keep in mind,

- Standard Rated Sales (15%) : These are the supplies of goods and services made by a VAT-registered business on which it is legally required to charge its customers a tax equal to 15% of the net sale value, and subsequently remit that collected tax to ZATCA .

- Sales on which the Govt. bears the VAT: This refers to a specific mechanism, primarily used in countries like Saudi Arabia (KSA), where the government effectively pays or reimburses the Value Added Tax (VAT) on certain goods or services on behalf of a specific segment of its citizens.

- Zero Rated Domestic Sales: Zero-Rated Domestic Sales are the supplies of specific goods or services made within the local jurisdiction (domestic) on which the seller charges VAT at a rate of 0% (0\%).

- Exports: An export is a 0% rated sale that allows the seller to reclaim the VAT paid on its associated business expenses.

- Exempt Sales: In the VAT context, Exempt Sales (or Exempt Supplies) are transactions that are taken completely outside the VAT system

- Standard Rated Domestic Purchases (15%) is the total value (excluding VAT) of all goods and services a company purchased locally, for which they were charged the 15% VAT rate by their suppliers.

- Imports subject to VAT paid on imports(15%), This value represents the total value (excluding VAT and Customs Duties) of taxable goods a company imported, for which they physically paid the 15% VAT at the border. Businesses report this to ZATCA in their VAT Return to recover it as Input VAT

- Imports subject to VAT accounted for through the reverse charge mechanism (15%) refers to the value of taxable services (like consulting or digital services) a Saudi company purchases from a supplier outside the GCC region. Since no customs process exists for services, the Reverse Charge Mechanism (RCM) makes the local customer responsible for declaring the 15% VAT as both a sale (Output VAT) and a purchase (Input VAT) on the same VAT return, effectively resulting in zero net cash payment to ZATCA, but ensuring the transaction is accounted for.

- Zero Related Purchases: Zero-Rated Purchases refers to the value of goods and services a business buys that are subject to a Value Added Tax (VAT) rate of 0%.

- Exempt Purchases: Exempt Purchases refers to the value of goods and services acquired by a business in Saudi Arabia that are categorically excluded from the scope of Value Added Tax (VAT) law.

Still doubtful? Give us a call on 📞 +966 56 927 1692

🌐www.numberoneerp.com